After a rollercoaster few years, the housing market in Southwest Florida's Lee and Collier counties is settling into a more normal rhythm. Post-pandemic price surges have leveled off, inventory has rebuilt from record lows, and buyers are regaining some leverage as we head into 2026. Below, we break down the key trends from 2024 and 2025 – and what they mean for local REALTORS® and the community.

📊 Key Takeaways (2024–2025 at a Glance)

- Prices plateau but remain high: Home values are holding near all-time highs, essentially flat year-over-year in late 2025 and still far above pre-2020 levels. Lee County's median single-family price hovered around $390K (−2.5% YoY) in Oct 2025, while Collier County's was about $744K (−1.5% YoY) – a gentle softening after the pandemic boom.

- Inventory rebounds strongly: From less than 1 month of supply in 2021 to roughly 7–9 months by end-2025, the home inventory in SWFL has swung back in favor of buyers. Active listings across Lee and Collier topped 18,000 in late 2025, providing far more choice than the drought of 2021.

- Sales volume recovering: After a slowdown in 2022–2023, buyer activity picked up notably in 2025. By October 2025, combined single-family sales in the coastal counties were up ~27% year-over-year, and pending sales surged over 50% – the strongest growth since 2021. Demand is adapting, not disappearing, even amid higher interest rates.

- Homes taking longer to sell: The median time on market has stretched from mere days at the peak of the frenzy to 2+ months by late 2025. Sellers face more competition and must price strategically, while buyers can afford to be choosier.

- Cash is king amid high rates: With mortgage rates peaking above 7% in 2023, a record share of transactions went to cash buyers. Nearly 50% of single-family and 70% of condo sales were cash at one point, reflecting an influx of equity-rich buyers and an affordability crunch for financed homebuyers (first-timers made up only ~21% of recent purchases).

Each of the sections below delves deeper into these trends, with interactive charts comparing 2024 vs. 2025 month-by-month to visualize how dramatically the market has recalibrated.

Prices Remain High – but Growth Has Stalled

Southwest Florida home prices today sit well above pre-pandemic levels – yet the runaway appreciation has cooled. During 2020–2022, median sale prices skyrocketed across the region, fueled by migration, low interest rates, and scarce supply. Single-family homes in Lee/Collier roughly doubled in price from 2018 to their peak in 2022, while condos surged even more. However, 2023–2024 brought a modest correction. As the chart below shows, median prices in 2025 tracked closely to 2024, with slight softening in some months.

By late 2025, the median single-family price in SWFL was about $468,000, off its mid-2022 high (~$540K) but nearly 80% higher than in 2018. Condo/townhouse medians (around $355,000 at end-2025) followed a similar trajectory – down from peak, yet ~60% above pre-COVID norms. This price resilience is echoed in local market stats: the regional median price was ~$410K in Oct 2025, essentially unchanged year-over-year. In short, home values have held steady in 2024–25 even as the market cooled, a testament to the area's continued desirability and equity gains locked in during the boom.

That said, sellers have had to adjust from the days of name-your-price increases. We've seen gentle year-over-year declines in median price for the first time in years in pockets like Fort Myers (−2% to −5%) and Naples (−1% to −3%). Higher-priced segments saw buyers become more price-conscious, and overpriced listings now require price cuts to sell. Overall, however, the feared "price crash" never materialized – instead, Southwest Florida's prices are flattening into a new equilibrium, still "far above pre-COVID levels despite recent corrections."

For real estate professionals, this pricing plateau means competitive pricing strategy is key. Sellers can no longer count on automatic appreciation; condition and location must justify the asking price. For buyers, stable prices and less frenzy offer breathing room – but also mean that significant bargains or dips have been rare. The market's value reset appears to be more of a soft landing than a hard crash.

Inventory Rebound Shifts Leverage to Buyers

Perhaps the most dramatic shift from the pandemic frenzy has been the explosion of inventory. In 2021, Southwest Florida had virtually no homes for sale – at one point, less than a 1-month supply (and under 3 weeks for condos!). Properties were snapped up immediately, leading to bidding wars. Fast forward to late 2024 and inventory hit multi-year highs: by November 2024, months' supply swelled into the double digits for the condo market, and around 10–11 months for single-family – firmly a buyer's market by traditional definition.

This normalization of supply is good news for buyers and the overall health of the market. As of December 2025, the single-family inventory sits around 6.8 months and condos around 9.2 months – much closer to a balanced market. In raw numbers, listings across Lee and Collier topped 18,600 in late 2025, up from just a few thousand at the 2021 trough. "Buyers have more choices and sellers face more competition" now, a complete reversal from two years ago.

For Realtors and sellers, the message is clear: unlike 2021's frenzy, today's buyers won't hesitate to look at the next listing if a home is overpriced or not in show-ready condition. Proper staging, accurate pricing, and patience are vital in this environment. The silver lining is that increased supply, combined with still-strong demand, has moved us toward a healthier, more balanced market. As Florida Gulf Coast University's analysts noted, inventory growth has finally "settled into balance after years of volatility."

Buyers, especially those who were sidelined in the frenzy, now have opportunity: more inventory means a better chance to find the right home without rushing. There is room to negotiate again on price and contingencies in many cases. The market leaning slightly to the buyer side is also encouraging some who put off selling (for fear of not finding a new home) to list their properties, further bolstering inventory in a self-reinforcing cycle.

Sales Volume Rebounds as Demand Adapts

Higher interest rates threw cold water on Southwest Florida home sales in 2022 and early 2023 – but 2024 and especially 2025 showed that demand is alive and adjusting to the new normal. After a lull, buyers have been coming back into the market, aided by gradually improving interest rates and growing inventory. In fact, the latter half of 2025 saw a notable uptick in closed transactions across the region.

The chart above illustrates the monthly patterns: October 2025 saw nearly 1,586 single-family homes sold across Lee and Collier, with December 2025 closing strong at 1,821. Pending sales – a forward-looking indicator – were up even more dramatically, signaling stronger closings ahead. Realtors noted "closings up 16% and pendings up 28% in the last 60 days" heading into the holiday season.

What's driving this rebound in activity despite still-elevated mortgage rates? Several factors: slightly lower rates in late 2025 (more on that below), improved selection of homes (less frustration for buyers), and pent-up demand from those who sat out the frenzy or held off during 2022's spike. Additionally, Southwest Florida continues to benefit from in-migration and a robust local economy – people still want to live and invest here. Even as some buyers paused due to affordability, others adapted (choosing adjustable-rate or buydown mortgages, or tapping larger down payments). Investors also took advantage of price softening in 2023 to add to their portfolios.

For the community, rising sales are a positive sign that the housing market is finding its new equilibrium. Homes are changing hands at a healthy clip, enabling mobility and new opportunities. For agents, the resurgence in transactions is welcome relief after the slower stretch – but serving today's buyers often means educating them on interest rate strategies and navigating a less frenzied but more complex market. Deals are happening, but they often require more negotiation and finesse than during the free-for-all of 2021.

Homes Are Taking Longer to Sell (Back to Normalcy)

One clear indicator of the market shift is the time it takes to sell a home. During the peak frenzy, properties in Southwest Florida often went under contract in mere days – sometimes hours – after listing. In mid-2021, the median days on market (DOM) for single-family homes dropped to just 6 days (and an incredible 4 days for condos!). Essentially, half of all homes were selling in under a week, a testament to the feeding-frenzy conditions.

Today, those days are gone. As inventory grew and buyer urgency waned, marketing times have stretched out close to historic norms. By late 2025, median DOM for single-family homes is around 54–57 days, and for condos about 62–63 days. In other words, most homes now take roughly 2 months to find a buyer, compared to under a week at the height of the boom.

Longer sale times are a natural consequence of higher supply and cautious demand. Buyers now have the luxury of time – more properties to consider and less fear of missing out. They can compare options, schedule multiple showings, and negotiate after inspection without feeling pressured by 10 other bids. For sellers, this means adjusting expectations: that early flurry of showings and instant offers is no longer the norm. It's now common for a home to sit on the market for several weeks before the right buyer comes along.

Realtors should prepare sellers for this reality with clear communication and marketing plans that extend beyond the first weekend. Price reductions after a month on market, staging refreshes, or other strategies might be needed if interest is lukewarm. The upside is that today's buyers, while slower to commit, often are more serious by the time they make an offer (having done their homework over those weeks). Deals may take longer to materialize, but they are typically cleaner and more calculated than the hurried offers of 2021.

It's worth noting that list-to-close times (from listing to finalized sale) have also lengthened – now roughly 90–100 days median – partly due to longer marketing time and also slightly longer contract periods. In 2021, many deals were cash with 2-week closings or buyers waiving contingencies to close fast; now 30–45 day closings are common again, and financing/inspection periods are back in play. In sum, the market has reverted to a more measured tempo, resembling 2018–2019 more than 2021–2022.

Cash Buyers and Affordability: A Tale of Two Markets

An interesting byproduct of the recent market cycle is the surge in cash buyers and what it says about affordability. Southwest Florida has always attracted cash purchases (thanks to retiree and second-home buyers), but even so, the proportions during the past two years have been striking. Pre-pandemic, around 30–40% of single-family sales and ~50–60% of condo sales were cash. Those figures dipped in 2019 when rates were low (cheap money made financing attractive).

However, as mortgage rates shot up in 2022–2023, the balance tilted sharply back to cash. By early 2024, over 40% of single-family home sales were cash and for condos it was as high as 67% cash. These were elevated levels of all-cash transactions. Investors, affluent Northeastern buyers, and institutional funds filled the gap while many first-time or mortgage-dependent buyers got priced out. In fact, first-time buyer share nationally fell to just 21% – a historic low – underscoring the affordability crunch.

This two-tier market – cash vs. financed – remains a defining feature going into 2026. The good news: as rates began inching down in late 2025, financed buyers are slowly returning, and the cash share has receded a bit (around 38.7% SFH, 65% condo as of Dec 2025). But we are still well above pre-pandemic cash levels. For local communities, the dominance of cash buyers highlights an affordability challenge. Middle-class families and first-timers reliant on mortgages are facing not only higher monthly payments due to 6–7% interest rates, but also stiff competition from cash-rich buyers who can waive appraisal concerns and close quickly.

Realtors should be prepared to help financed buyers craft creative offers – for instance, offering a larger down payment, using rate buydowns, or considering slightly lower-priced homes that leave room in the budget. Educating buyers about Florida's insurance and tax costs is also key, since those impact affordability and often cash buyers factor these in differently than financed buyers. On the seller side, a cash offer is still gold for its certainty, but as the market balance improves, sellers might see more financed offers coming in that are worth considering, especially if they come from well-qualified local families.

📋 FinCEN Reporting Rule Update

The prevalence of cash (and concerns about illicit money in real estate) led FinCEN to introduce new rules for title insurance companies to report certain all-cash purchases by business entities. Implementation of these rules was delayed to March 2026, but it's something to watch as it could slightly affect investor behavior in the coming year, particularly in markets like Southwest Florida that saw big cash inflows.

December 2025: Year-End Market Snapshot

As we close out 2025, the December market data puts an exclamation point on a year of recalibration across Southwest Florida. Each submarket tells a compelling story of recovery, rebalancing, and realistic pricing – a dramatic change from the extreme seller's market of two years ago.

Bonita Springs & Estero – December 2025 vs December 2024

This local submarket saw a notable rebound in sales as the year closed. In Bonita Springs-Estero, closed sales jumped to 159 in December 2025, up 21% from 131 a year earlier. Buyer demand picked back up in this Lee County submarket, even as prices eased slightly – the median sale price in Bonita/Estero was about $520,000, down from $575,000 in December 2024.

Inventory levels remained roughly steady (1,267 active listings vs 1,283 a year prior), but with higher sales the months' supply of homes for sale improved to approximately 8 months (from nearly 10 months the prior December). Homes are spending longer on the market than last year – often around 2–3 months to sell now versus under 2 months a year ago – reflecting a more deliberate pace. Overall, Bonita Springs and Estero ended 2025 on a balanced note: solid buyer interest (more sales) tempered by realistic pricing (slightly lower prices and longer selling times), a clear sign of the post-frenzy market normalization.

📥 December 2025 Infographics

Naples Area (Collier County) – December 2025 vs December 2024

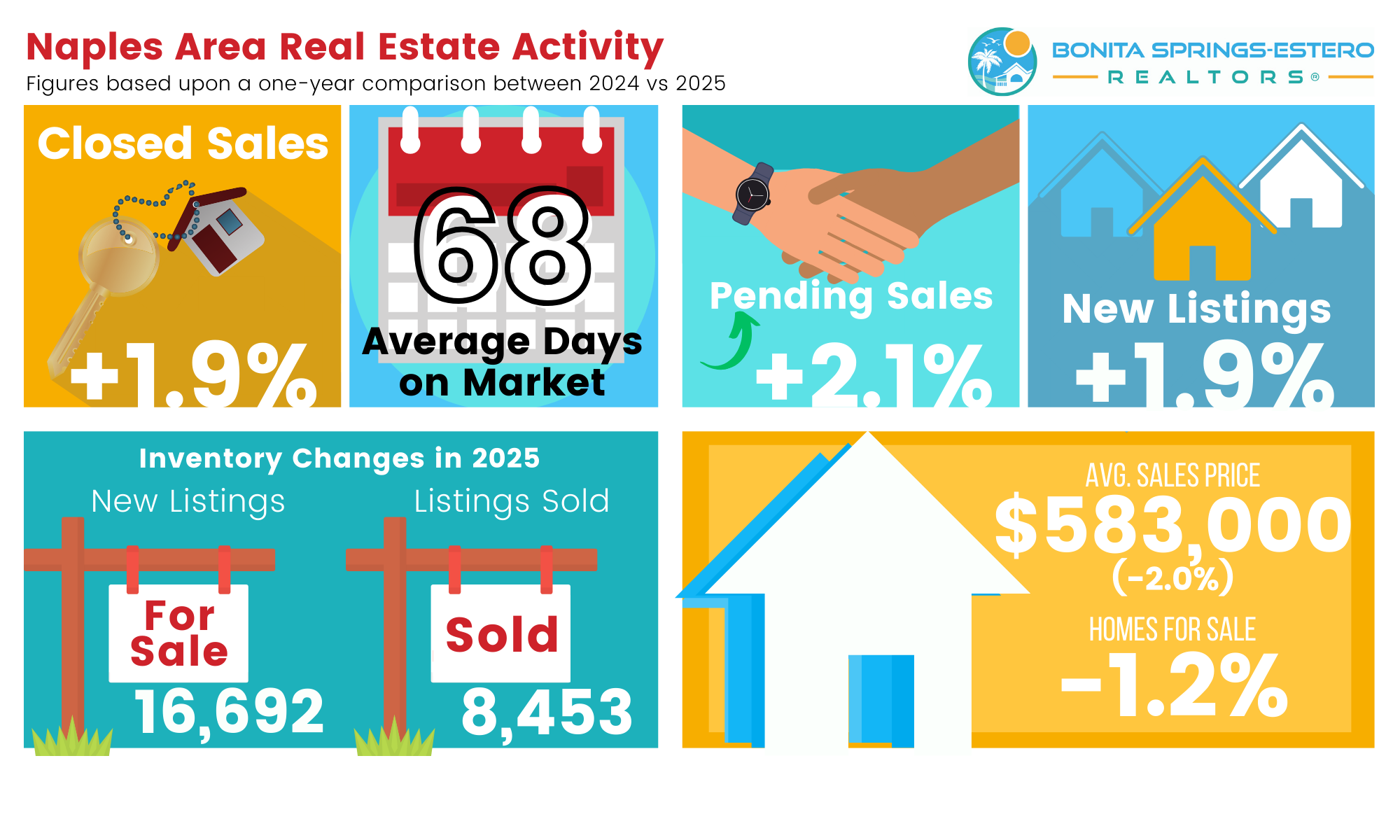

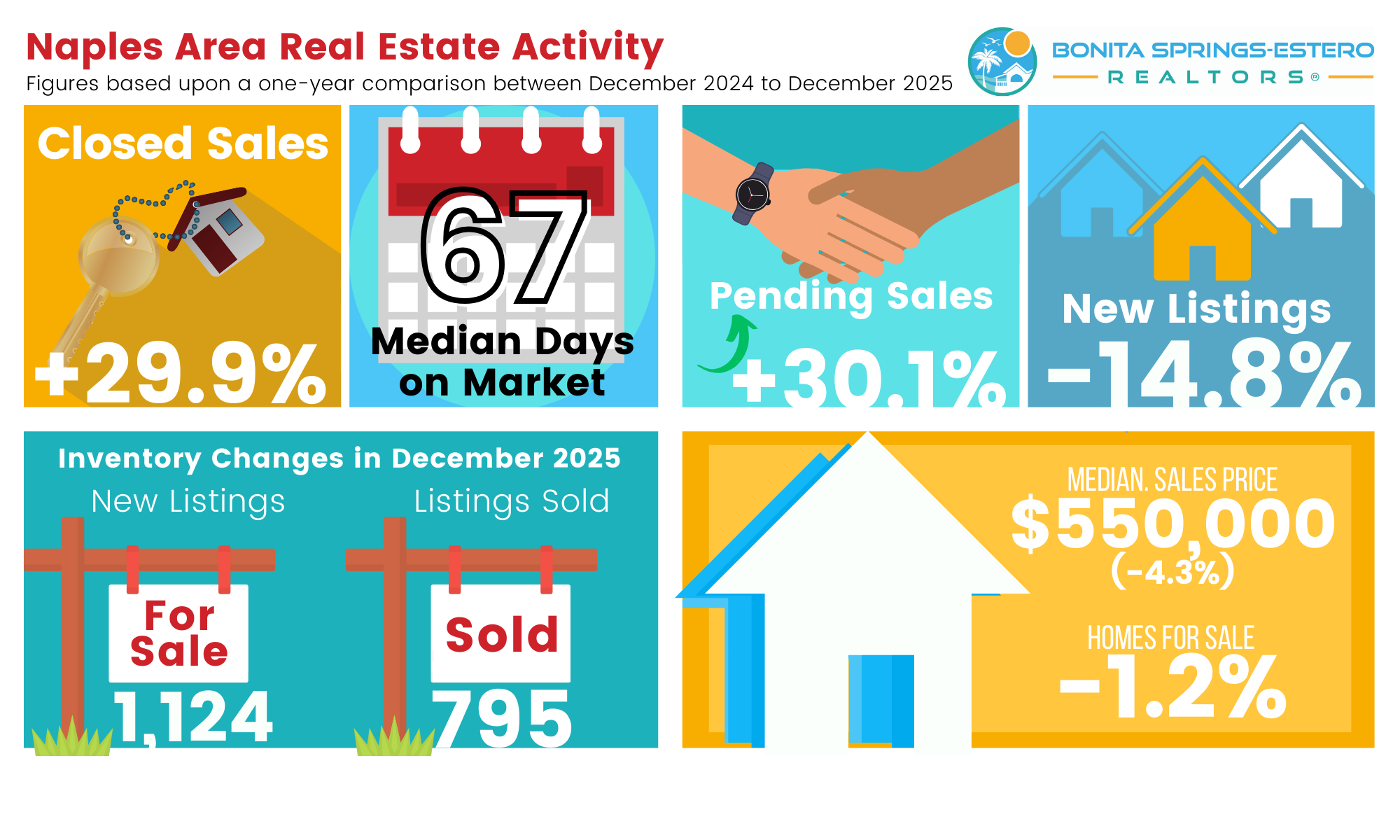

The Naples market finished the year with strong sales momentum and slight price softening. The Naples area logged 790 closings in December, a surge of 29% from 612 in the same month of 2024. This significant jump in transactions – the highest among the Southwest Florida submarkets – underscores how buyer activity roared back in Collier County as 2025 progressed.

At the same time, Naples' median sale price dipped modestly to roughly $550,000, about 4% lower than $575,000 a year prior. In fact, prices in Naples have been essentially flat to slightly down throughout 2025, a far cry from the double-digit gains of the pandemic boom. Inventory in Collier County was nearly unchanged at year-end (about 6,312 active listings vs 6,403 in December 2024), but fewer new listings came to market this December (–15% YoY) – many sellers held off, given the more competitive conditions.

With supply steady and sales way up, the Naples area's months' supply shrank to approximately 8 months, down from roughly 10+ months a year earlier, pointing to a much more balanced market. Buyers still have ample choice (over 6,000 homes for sale) but no longer any glut of inventory, and they can be selective. Homes in Naples are taking longer to sell on average – the median DOM is now about 109 days (over 3.5 months to go under contract) in Collier, compared to roughly 70–80 days a year ago – but this reflects a return to normal seasonality and patient, value-conscious buyers. All told, Naples closed out 2025 with healthy sales volumes, stabilizing prices, and inventory near equilibrium, a welcome reset after the rollercoaster of the prior few years.

Cape Coral–Fort Myers Area – December 2025 vs December 2024

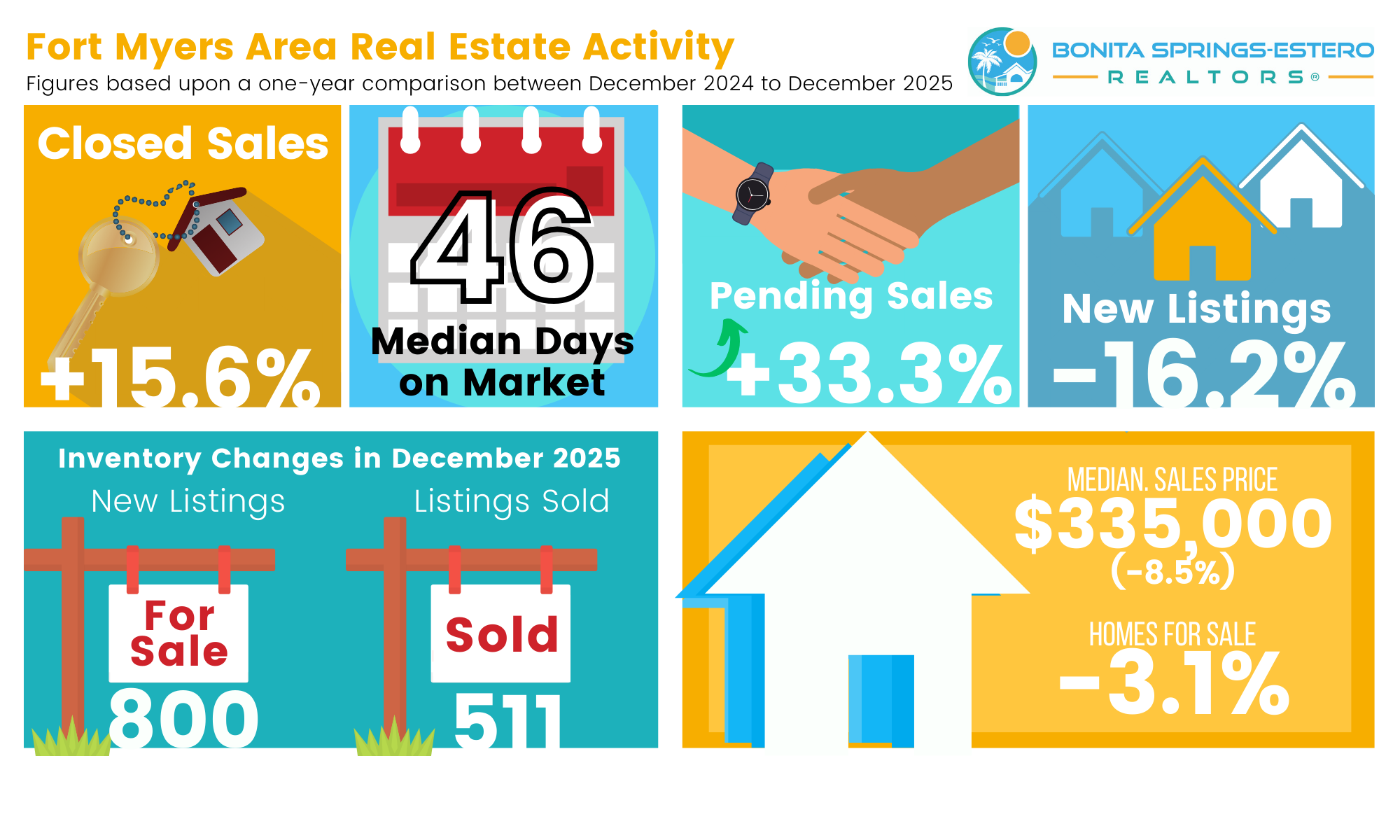

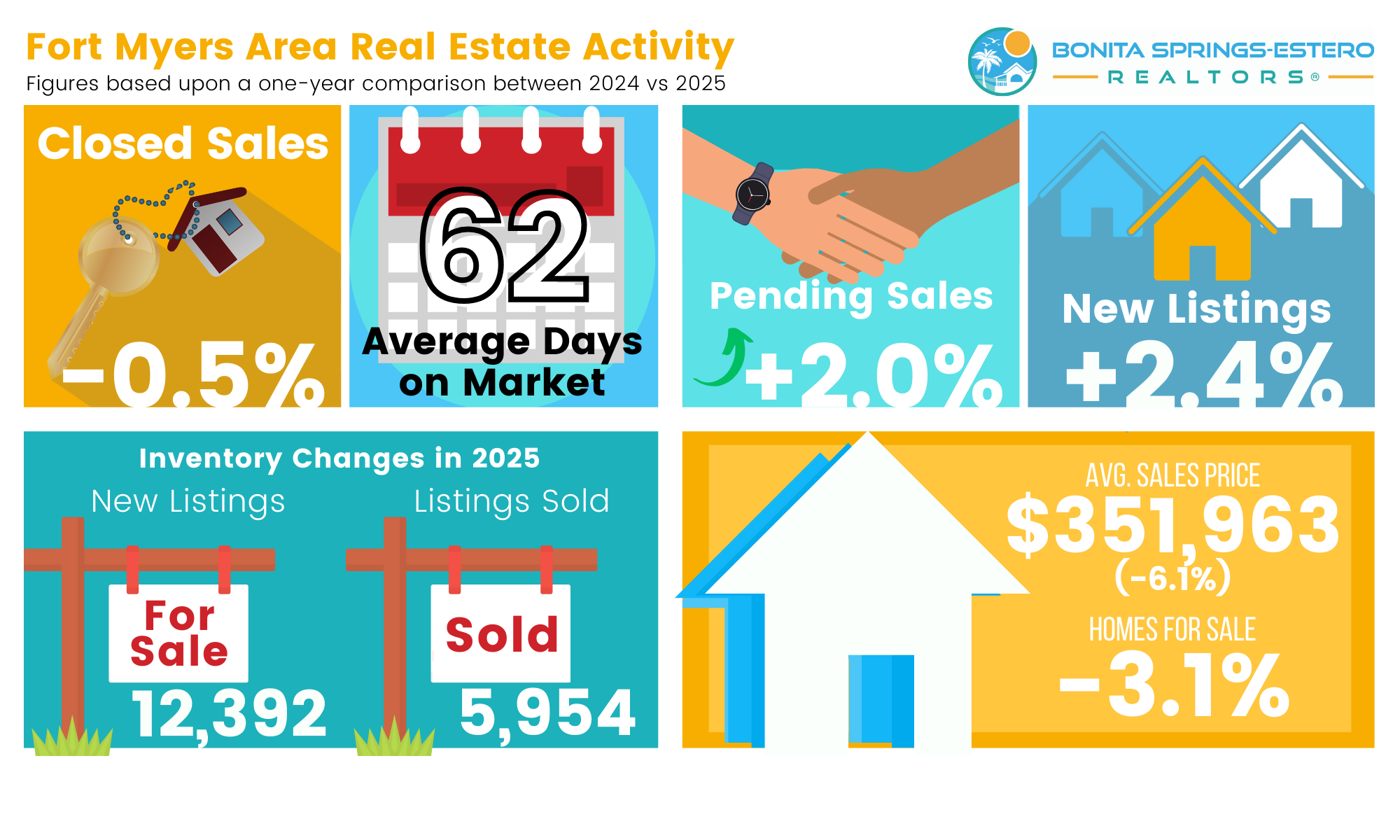

Lee County's major market (excluding Bonita/Estero) is settling into balanced conditions. The greater Fort Myers/Cape Coral area recorded 470 closed sales in December, up about 12% from 420 a year earlier. This continued rise in transactions indicates that buyers have been gradually re-entering the market despite higher interest rates – a trend noted across Southwest Florida in late 2025.

Home prices in this area have edged down from last year's levels: the median price was around $330,000 in December 2025, about 9% lower than $362,500 a year prior. Some of that decline is due to a shift toward more mid-priced and affordable homes now selling (as opposed to 2021's luxury skew); it also reflects sellers pricing more realistically to get deals done.

On the supply side, active listings stood at 3,792 in December (vs 4,004 a year ago) – inventory leveled off after swelling in 2024. With fewer new listings coming on (–14% YoY), inventory actually dipped slightly below last year. Coupled with the uptick in sales, the months' supply in greater Fort Myers is now about 7.5–8 months – down from roughly 9–10 months 12 months prior – marking the first time since the pandemic frenzy that Lee County's supply is back in the balanced range.

Homes are generally taking around 90+ days to sell here (versus ~60–70 days a year ago), which is much closer to historic norms and signals that buyers can take their time and won't leap at overpriced listings. Notably, even Fort Myers Beach – hit hard by Hurricane Ian in 2022 – saw a rebound: December sales on Fort Myers Beach jumped 68% (37 closings vs 22 in December 2024) as rebuilt homes and condos came online. However, the median price on Fort Myers Beach fell to $520K (–24% YoY), reflecting a post-storm shift in the mix of properties selling. Across the broader Cape Coral–Fort Myers market, the takeaway at year's end is positive: buyers have more choices and better value, and sellers who price to market are finding willing buyers.

📥 2024 vs 2025 Year-Over-Year Infographics

Big Picture – A Balanced Finish to 2025

These December metrics put an exclamation point on a year of market recalibration in Southwest Florida. Region-wide, inventory held steady (active listings in SWFL ended about 2% higher than a year ago) and prices essentially plateaued after the slight corrections of 2023. The surge in sales in the last quarter of 2025 (with December's closings well above December 2024 across Lee and Collier) helped total annual sales in 2025 roughly equal 2024's volume.

In other words, the lull in early 2025 was offset by a strong finish – a trend agents had been watching as pending and closed sales outpaced last year for months in a row. Homes are no longer flying off the shelf, nor are prices climbing recklessly – instead, buyers and sellers are meeting in a middle ground. Median prices in most areas are within 5% of last year's levels (down a touch in 2025), and buyers now enjoy a near-normal supply of homes for sale instead of scraping for scraps.

As one local broker put it, "with inventory returning to pre-pandemic levels and demand improving, the foundation is in place for an even better 2026." Entering the peak winter season of 2026, Southwest Florida's housing market appears healthier and more balanced than it's been in years – a market no longer defined by frenzy or free-fall, but by a sustainable equilibrium where informed buyers and sellers can finally navigate with confidence.

📄 Download Full Reports

📑 December 2025 Monthly Indicators (PDF) | 📑 Fast Stats December 2025 (PDF)

🎥 Video Analysis

Watch our video breakdowns of the December 2025 market data:

Looking Ahead: Opportunities in a Balanced Market

Entering 2026, Southwest Florida's housing market is neither red-hot nor ice-cold – it's somewhere in between, a balanced market with its own unique opportunities and challenges. The economic fundamentals of the region remain strong: job growth and population inflows continue, and even the recent uptick in tourism (RSW airport's record traffic and surging resort taxes) suggests our region's desirability isn't fading. This bodes well for housing demand in the long run.

Mortgage rates will be a key factor to watch. The 30-year fixed rate dropped to 6.19% in December 2025 – actually a dip from the 7.33% peak in November 2025 and far below the 7%+ rates seen in mid-2024. If rates continue to gently decline or even stabilize in the 5–6% range, we could see a further unlock of pent-up demand in 2026. Each point of rate relief brings more buyers back into play or increases budgets slightly. Realtors should keep their pre-approved buyers updated on rate changes, as improved affordability could spur them to act.

For sellers and homeowners, the current market offers a chance to move up or relocate with less stress than during the frenzy. Yes, your home might not fetch the crazy bidding-war price of 2021, but you're likely selling at a historically high value and then buying with far more choices available. It's a more rational market now – contingent offers can succeed, inspections are back, and negotiations are two-sided. Those who outwaited the frenzy now have an environment where transactions can be executed more prudently.

For the community, the recalibration of the housing market is healthy. A stable or gently rising price trend, increased inventory, and moderate sales pace help avoid boom-bust cycles and make housing a bit more accessible. There are still affordability issues – home prices are high relative to incomes, and rents remain elevated – but the recent shifts are allowing wages a chance to catch up somewhat. Policymakers and local leaders should seize this moment to encourage development of attainable housing and address insurance costs, so that Southwest Florida can retain its workforce and appeal to a broad range of residents.

🔑 Summary: The 2024–2025 Journey

The data tells a clear story: sales are rising, inventory is leveling off, and prices remain steady... signaling a shift toward balance after years of volatility. Both real estate professionals and consumers should welcome this stabilization. By being informed and adaptable, Southwest Florida's realtors and residents can thrive in this new landscape – one marked by neither frenzy nor fear, but by opportunity and a return to normalcy in our dynamic housing market.

For more local news and insights, visit BER News, and explore our Market Reports for the latest data on Bonita Springs and Estero's real estate trends.