Introduction: A Market in Recalibration

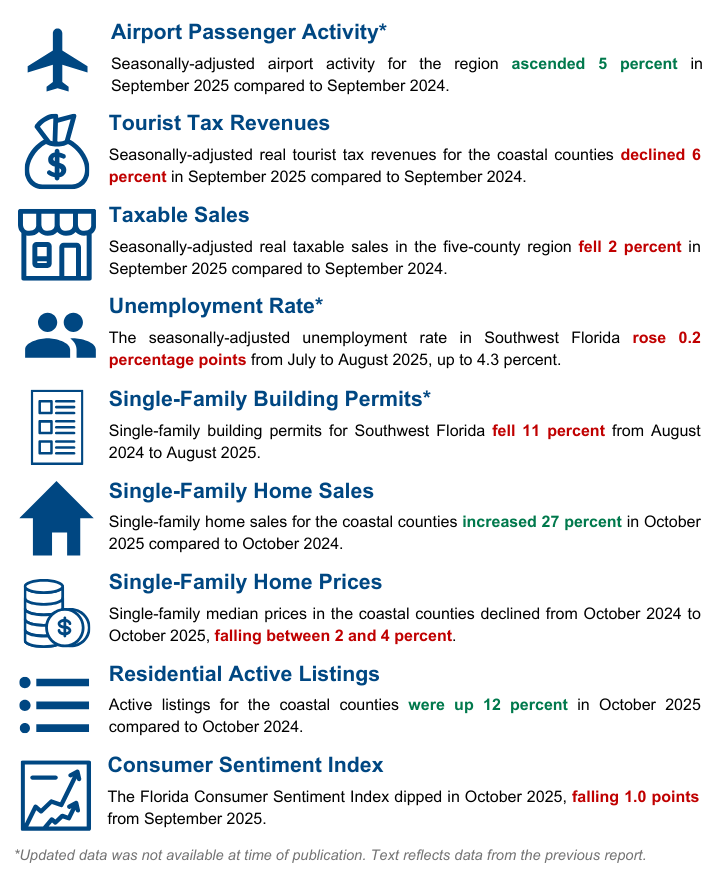

Southwest Florida’s housing market is entering a new phase of post-pandemic, post-hurricane recalibration. The latest Regional Economic Indicators – December 2025 report from FGCU’s Regional Economic Research Institute (RERI) paints a picture of a market stabilizing after the frenetic boom of 2021–2022. Home prices have essentially leveled off, residential inventory has expanded from last year’s lows, and consumers are increasingly cautious amid economic uncertainties. Bonita Springs-Estero, as part of the broader Cape Coral–Fort Myers area, exemplifies these trends.

“Overall, the housing market is moving from recovery to recalibration, with prices leveling and listings improving, though affordability pressures continue to weigh on long-term momentum.”

In this article, we delve into the key indicators—home prices, inventory, and consumer sentiment—and discuss what they mean for homebuyers, sellers, investors, and real estate professionals across Southwest Florida.

Home Prices Plateau After Pandemic Surge

Home prices in Southwest Florida have flattened out, marking a dramatic shift from the double-digit gains (and subsequent corrections) of the past few years. As of October 2025, the median single-family home prices in the coastal counties showed a modest year-over-year decline: Lee County (Cape Coral–Fort Myers) saw a median of roughly $390,000, about 2.5% below last October’s level, while Collier County (Naples area) recorded a median around $744,000, roughly 1.5% lower. Even Charlotte County (Punta Gorda) experienced a slight dip, with a median near $342,000, down about 3.7% annually. These 2–4% declines are relatively minor—essentially a plateauing of prices—especially considering that earlier in 2025 the region had seen more pronounced drops.

The moderation of price declines suggests that the market has found its footing after the cooling period. Sellers are no longer slashing prices as they were when coming off 2022’s peak, and buyers are no longer chasing rapidly escalating prices—a sign of balance returning. Notably, Bonita Springs and Estero (which are part of Lee County) mirror this regional plateau. Local REALTORS® report that while asking prices remain high, bidding wars have eased and appraisal gaps have narrowed—a far cry from the frenzy of 2021. With single-family home prices in our area roughly 2–3% lower than last fall, many buyers see this as a welcome breather.

In practical terms, the typical home is selling for about the same as it did a year ago, or even a tad less, after years of run-up. The slight year-over-year declines can even be seen as a small price correction from the pandemic-era jump, helping improve affordability marginally. Indeed, the pace of price change has ranged from about –1% to –4% across different SWFL communities, essentially flat when adjusted for inflation. Overall, the era of rapid price appreciation has hit pause, and a new normal of stable prices is setting in—a dynamic that savvy buyers and sellers can strategize around.

Interactive Chart: Year-over-Year Median Home Price Change by County

Sales Rebound and Expanding Inventory

The volume of home sales in Southwest Florida has roared back from last year’s hurricane-induced slump. In October 2025, existing single-family home sales across the coastal counties jumped nearly 27% compared to October 2024. Lee County alone notched a 26.7% surge in sales transactions year-over-year, and Collier County saw an even larger jump of roughly 32%. This impressive rebound, however, comes with an asterisk: it partly reflects the unusually soft sales last fall after Hurricane Ian and tropical storms Helene and Milton disrupted the market in late 2024. In other words, last year’s baseline was low, making this year’s gains look especially robust. Even so, the pickup in closings is real—buyers are back in the game and properties are changing hands at a healthy clip.

Crucially, inventory has also improved, moving the market toward balance. Residential active listings have risen by roughly 12% versus a year ago, indicating more homes available for sale than last fall. This increase in supply is a reversal from the extreme scarcity of homes in 2022–2023. In fact, earlier this year inventory was growing at an even faster year-over-year clip—nearly 40% higher in March 2025 compared to March 2024—before leveling off by autumn. The upshot is that buyers now have more options to choose from than they did a year ago. The Southwest Florida market now has a bit more breathing room, with months’ supply edging up and fewer instances of 10-offer bidding wars on day one.

It’s worth noting that after peaking in late summer, the number of homes on the market has actually ticked down month-to-month heading into the winter season. This is a normal seasonal pattern—many sellers listed properties over the summer, and now some listings are being absorbed as snowbird season kicks in. For buyers, this means the best window of plentiful choice may be right now—before the influx of seasonal demand in the new year potentially tightens supply again. For sellers, the message is that inventory conditions are more competitive than a year ago, so pricing a home correctly and ensuring it shows well have become critical. Gone are the days of throwing a property on the market at any price and watching it sell; today’s buyer has other options and more bargaining power.

Another factor tilting the scales is mortgage rates. Encouragingly, financing costs have eased slightly from their peaks. The average 30-year fixed mortgage rate has come down to around the low-6% range, after flirting with 7% earlier. This rate relief expands the pool of qualified buyers and improves affordability a bit—“more buyers can enter the market ahead of season,” as the FGCU economists note.

Navigating Affordability and Economic Pressures

Despite these positive trends in sales, supply, and rates, affordability remains a central challenge in Southwest Florida’s housing landscape. Many families are still grappling with the total cost of owning a home, which extends beyond just the purchase price. Insurance costs, taxes, and other carrying costs have been on the rise, eating into affordability gains from the recent price plateau.

“Affordability remains a central challenge, with average home insurance premiums increasing 1.5 percent statewide and foreclosure rates climbing across several Florida metros.”

Moreover, Southwest Florida has seen a worrying uptick in foreclosure rates, indicating that a segment of owners is under financial stress. The Cape Coral–Fort Myers metro now ranks among the highest in the nation for foreclosure rates. Some of this is the lingering effect of 2022’s Hurricane Ian—damaged or disrupted properties leading to loan defaults—and some is due to general affordability issues as interest rates climbed and pandemic-era forbearances ended.

On the economic front, Southwest Florida’s job market has cooled, which can both relieve and exacerbate housing affordability. Unemployment in our region stands near 4.3%—higher than a year prior—and the latest data show job growth has essentially stalled, with only modest net new jobs added over the most recent quarter. Sectors like leisure and hospitality are still regaining footing, whereas education and health services have grown modestly. For real estate, a softer labor market is a double-edged sword. On one hand, slower job and wage growth can temper housing demand; on the other hand, a cooling economy has prompted the Federal Reserve to ease up on interest rates, which is why we’ve seen those mortgage rates dip.

For now, wages in Florida have not fully caught up with housing costs, though there’s been slight improvement in affordability indices. The Housing Affordability Index (HAI)—which measures whether a typical family earns enough to qualify for a median-priced home—improved in 2025 for many SWFL counties, thanks to the stabilization of prices and rising incomes. Lee and Charlotte Counties’ HAIs moved above 1.0, whereas Collier’s remained just below 1.0, indicating a persistent gap.

“Housing affordability has been a persistent thorn to the real estate market.”

Consumer Sentiment: Caution Clouds the Horizon

Layered atop these local market dynamics is the mood of the consumer, which has turned notably cautious both regionally and nationally. Consumer sentiment in Florida has been on a downward trend for months, reflecting growing wariness about the economy. The University of Florida’s consumer sentiment index for the state fell into the upper-70s by October 2025 after starting the summer in the mid-80s. Nationally, the sentiment is even more subdued: the University of Michigan’s U.S. consumer sentiment index dropped to 51.0 in November—nearly a record low and only a point above the trough hit in June 2022.

This erosion in sentiment matters for real estate because buying a home is as much an emotional decision as an economic one. When consumers feel confident—about their job security, income prospects, and the economy—they are more likely to make big purchases like homes. When confidence falters, people tend to postpone or scale back such decisions. The current sentiment indexes suggest a psychological headwind in the market: some potential buyers may choose to wait, worried about everything from inflation to political gridlock.

It’s important to emphasize, however, that low consumer sentiment can turn on a dime with changing conditions. Interestingly, November’s national survey hinted that sentiment ticked up slightly once a temporary federal government shutdown ended, showing how sensitive confidence is to headlines. Looking ahead, a few developments could brighten the mood: further easing of inflation, more Fed rate cuts in 2026, and potential policy actions around insurance or property taxes. For now, though, expect the prevailing attitude to be one of “careful optimism”—many consumers believe the long-term fundamentals of Southwest Florida are strong, but they’re being prudent in the short term.

Interactive Chart: Consumer Sentiment – Florida vs. U.S. (Summer–Fall 2025)

Opportunities and Outlook for Bonita Springs-Estero and Beyond

What do these economic indicators mean for homebuyers, sellers, and investors in the Bonita Springs-Estero area? In a nutshell, they point to a market that is cooler and more balanced than the frenzied days of 2021, but still fundamentally robust in the long run. For homebuyers, especially first-timers or newcomers to Southwest Florida, the current moment offers a relative sweet spot: prices are not running away, inventory is better stocked, and interest rates—while higher than the ultra-low levels of 2021—are off their recent highs. This combination can translate into negotiating power.

For sellers, the new indicators counsel realism and adaptability. Homes will still sell—remember that sales counts are up strongly year-on-year—but the pricing strategy is key. Overpricing a listing in today’s market is risky, as price-sensitive buyers have plenty of alternatives and are quick to move on. One opportunity for sellers is that mortgage rate buydowns or concessions can go a long way: since buyers are wary of costs, a seller who offers to pay points to reduce the buyer’s interest rate, or covers some closing costs, might stand out and achieve a better net price. Essentially, seller creativity and flexibility can pay off in a market where consumers are skittish.

For investors and prospective real estate professionals, Southwest Florida’s economic indicators signal a return to fundamentals. The frenzy of speculative flipping is giving way to longer-term investment plays—focusing on rental income potential, property improvements, and value-add opportunities. With regional employment growth slowing and wage growth moderate, rental demand may stay solid (as some would-be buyers hold off and continue renting). Investors can capitalize by purchasing properties at today’s flatter prices, with the knowledge that SWFL remains a growth region attracting retirees and remote workers.

In summary, the December 2025 FGCU economic indicators deliver a clear message: Southwest Florida’s housing sector is stabilizing into a healthier equilibrium after several years of roller-coaster extremes. Home prices are holding steady, inventory is gradually normalizing, and consumer attitudes—while cautious—are not derailing activity. The broader economy’s cross-currents (a cooling job market but easing inflation and interest rates) suggest that 2026 could bring increased affordability if rate cuts continue, or at least prevent any major shocks to our real estate market. For the Bonita Springs-Estero community, these trends create an environment of opportunity and adjustment.

Buyers have a chance to secure properties without the panic of a red-hot market. Sellers can still achieve solid prices, especially if they adapt to the new norms. And REALTORS® and investors can help shape the next phase by focusing on value, guidance, and long-term thinking. As always in Southwest Florida, challenges remain—from insurance woes to keeping housing affordable for our workforce—but the data give plenty of reason for optimism that our region’s real estate will navigate these challenges. The market’s recalibration is well underway, setting the stage for a more sustainable and strategic real estate climate as we head into the new year.