Southwest Florida’s housing market is gaining momentum as 2025 progresses, outperforming 2024 across key indicators. Closed sales, pending deals, and new listings all rose year-over-year in October, pointing to a market revival. Buyers are finding more inventory and opportunities with high season approaching, while recent Fed rate cuts are improving affordability and bolstering confidence for Bonita Springs and Estero real estate going into 2026.

2025 Market Outpaces 2024 in Southwest Florida

Want to dive deeper into the numbers? Visit our Market Reports page for the full October 2025 Southwest Florida housing statistics.

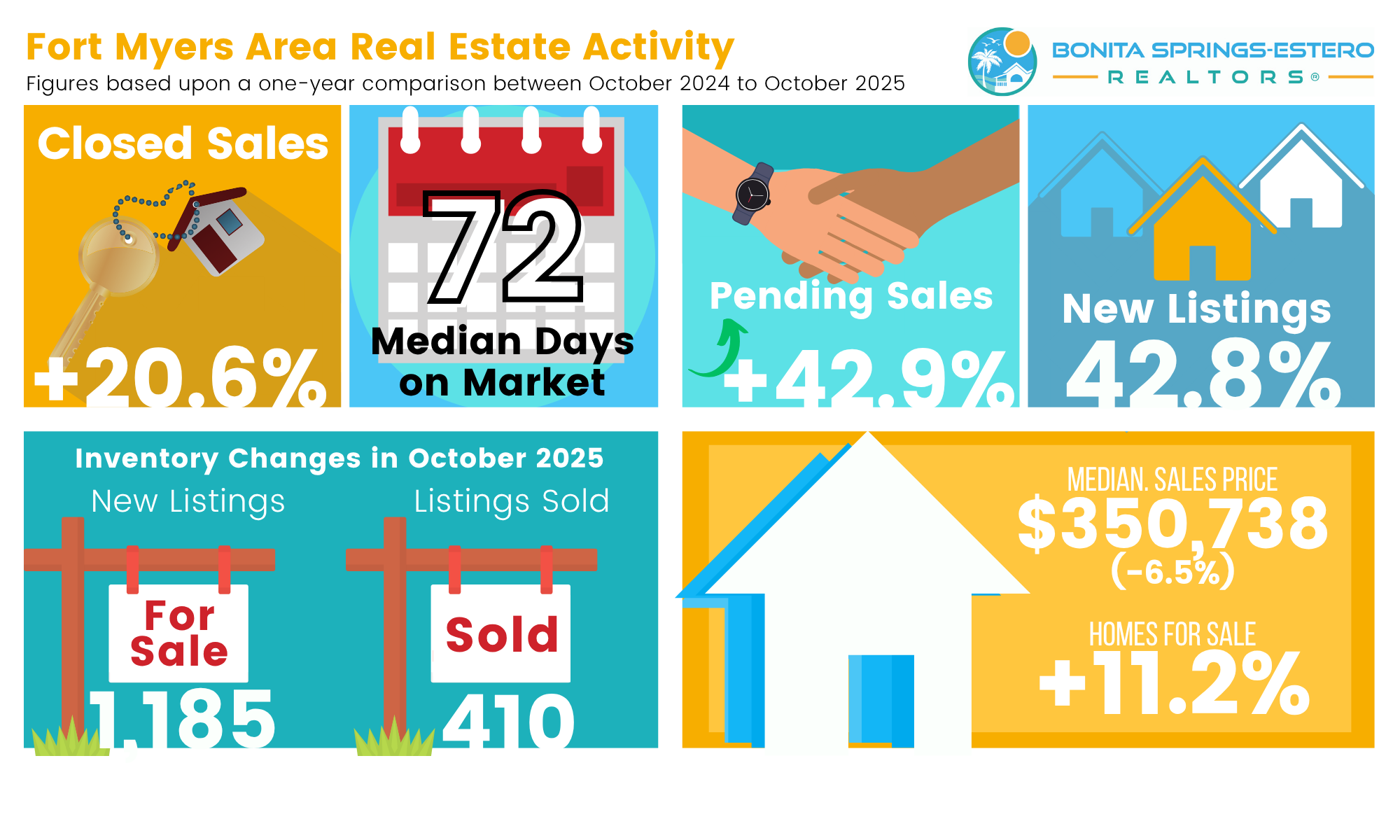

After a lukewarm 2024, the Southwest Florida real estate market is showing robust year-over-year gains in 2025. In October alone, closed sales across the region jumped about 8%, and pending sales surged by double digits. According to the Bonita Springs-Estero REALTORS® October market update video, “New listings climbed to 6,579 (up 13.0% year over year), while pending sales jumped to 3,421 (up 34.9%), signaling renewed demand after a quieter summer”. Closed sales improved to 2,600 units (up 8.0% from Oct 2024), and the median sales price held around $375,000 – a 4.2% annual increase, indicating price stability amid the higher volume. This solid performance means 2025 is shaping up stronger than 2024 on all fronts – more transactions are closing, and at slightly higher prices, compared to the previous year.

Realtor leaders note that Florida’s housing market has entered a healthier phase.

“Florida’s housing market continues to show strength and balance,” said Florida Realtors® President Tim Weisheyer, emphasizing that “closed sales are trending higher … and inventory levels are beginning to level off – all signs that Florida’s housing market remains one of the strongest in the nation.”

Even in Bonita Springs and Estero, local activity mirrors these positive trends. October’s single-family home sales in the Bonita-Estero area, for instance, were up about 20% from a year ago, and condo sales rose nearly 24%. Year-to-date figures tell a similar story: Southwest Florida’s 2025 sales volume and listing totals have overtaken 2024’s pace, reflecting a market that has not just normalized but is gaining ground heading into the winter.

Rising Inventory Creates Seasonal Opportunities for Buyers and Sellers

After two years of tight supply, housing inventory in Southwest Florida is finally on the upswing, opening a window of opportunity as the peak winter season arrives. The October market update noted that “inventory reached 26,077 homes (up 11.7% YoY), lifting months’ supply to 10.0 and giving buyers more choices, time to compare, and slightly wider negotiation room”. In other words, there are more homes for sale now than a year ago, which translates to greater selection and bargaining power for buyers. Properties are also sitting a bit longer before going under contract (median 69 days to contract versus 51 days last October), further easing the urgency for buyers.

“The Southwest Florida housing market is showing renewed balance this fall — and plenty of opportunity for both buyers and sellers.”

Sellers can still find motivated buyers, but realistic pricing and good presentation are crucial in this more balanced, buyer-informed market.

Crucially, this inventory buildup comes just as Southwest Florida’s high season approaches. Winter and early spring historically bring an influx of snowbird and tourist buyers to Bonita Springs, Estero, and surrounding areas. This year, those buyers will find a less frenzied market than in 2021–2022. Months’ supply of homes now sits in the mid-to-high single digits in many local markets, compared to just 1–2 months during the pandemic boom. For example, Bonita Springs currently has roughly nine months of inventory, creating a more relaxed pace – homes spend around 70 days on the market, and well-priced listings are still closing solid deals. By contrast, Estero’s real estate trends are a bit tighter: Estero has about 4–6 months of inventory and a median sale price near $555,000, with many homes selling in ~60 days. These levels put Estero in a balanced market position, while Bonita leans slightly toward a buyer’s market, but overall the Southwest Florida housing outlook is far more favorable for participants on both sides than it was a year ago.

Both buyers and sellers can benefit from the current conditions. Buyers heading into the 2025–2026 season will enjoy a wider selection of properties and more negotiating leverage on price and terms. Meanwhile, sellers who price their homes competitively are still achieving strong results, thanks to steady demand in desirable neighborhoods. “Buyers now enjoy more selection and negotiating power, [while] sellers who price strategically and present their homes well are still achieving excellent results,” observed a local market analyst about the region’s shifting dynamic. With new listings expected to increase further during the winter season, both parties should prepare: buyers should get pre-approved and be ready to act on the right home, and sellers should consider listing early and ensuring their home is show-ready to stand out in the growing inventory.

Rate Cuts Boost Buyer Confidence and Market Momentum

Another factor brightening the 2025 Florida housing outlook is the recent turn in monetary policy. The Federal Reserve implemented two small rate cuts in late 2025, a notable shift after years of rate hikes. These quarter-point cuts – most recently bringing the benchmark rate down to around 3.75–4.00% – are already filtering through to mortgage markets. Borrowers have seen mortgage rates dip from their peak levels, marginally improving affordability for home loans. In fact, Southwest Florida’s strong autumn sales came “largely driven by lower mortgage rates,” according to Florida Realtors®, which reported a resurgence in statewide home purchases as financing costs eased. With 30-year fixed mortgage rates hovering closer to the mid-6% range than the 7%+ seen earlier in 2025, more buyers are qualifying for loans and feeling confident about entering the market.

Economists expect these rate cuts to galvanize homebuyer demand in the coming months. History shows that falling interest rates can “lift home sales” by enabling more buyers to qualify for mortgages. We are already seeing hints of this effect: October’s pending sales in Southwest Florida jumped nearly 35% year-over-year, a sign that buyers who had held off during the high-rate environment are finally moving forward. Buyer confidence is getting a boost just in time for the winter season. “Lower rates tend to spur activity – every 0.5% drop in rates gives more households the ability to afford a home,” notes one national real estate economist. If the Fed continues a gradual cutting path into 2026, consumers could gain additional purchasing power. Bonita Springs housing experts anticipate a ripple effect: the combination of moderating prices and cheaper financing could draw out both first-time buyers and seasonal residents who sat on the sidelines.

This improving climate also benefits sellers and the broader market momentum. Homes that were previously out of reach for some locals may now fall within budget, shrinking the gap between buyer and seller expectations. And with the Southwest Florida real estate market already trending upward in sales volume, a dose of lower rates may sustain that momentum into next year. Mortgage affordability remains a key watch-point – factors like insurance and taxes are still hefty in Florida – but the direction is positive. As mortgage consultant companies often advise, buyers who secure a home while rates are lower can always refinance later if needed, whereas waiting might mean paying a higher price if home values keep rising. The recent rate cuts thus inject a sense of optimism that the market’s recovery can continue accelerating in Q4 2025 and early 2026, so long as economic conditions remain stable.

Looking Ahead: Optimistic 2026 Outlook for Southwest Florida Housing

With strengthening fundamentals and policy winds shifting, experts are upbeat about what’s in store for Southwest Florida real estate in 2026. Fears of a major downturn have largely abated.

“We could see further softening, but because there’s no excessive leverage in the market like in 2008, the risk of a full-blown crash is greatly reduced,” says Dr. Shelton Weeks, a finance professor at Florida Gulf Coast University.

This underscores that today’s correction is nothing like the mid-2000s bubble burst. In fact, many analysts now characterize the current phase as a healthy normalization after the frenzy of the pandemic years. Home prices have adjusted to more sustainable levels – in much of Southwest Florida, median prices are flat to modestly up year-over-year, and down from 2022 peaks, which is restoring affordability without erasing the sizable equity gains homeowners built over the past five years. Meanwhile, population growth and job gains in the region continue to fuel long-term housing demand, and the winter influx of retirees and second-home buyers shows no sign of waning.

Looking forward, the consensus among real estate economists is that 2025 will finish stronger than 2024, and that momentum will carry into 2026. The National Association of Realtors® projects a significant rebound in sales as interest rates stabilize – potentially on the order of a 10% increase in existing-home sales in 2025, followed by further growth in 2026. Florida-specific outlooks echo this optimism: Southwest Florida’s housing market is expected to remain one of the state’s more resilient areas, thanks to its desirability and the post-hurricane rebuilding boost in some communities.

“Maybe the worst is coming to an end… there’s going to be roughly a 10% boost of existing-home sales in 2025 and 2026,” NAR Chief Economist Lawrence Yun predicted, citing stabilizing mortgage rates and an easing inventory crunch.

If mortgage rates indeed settle around the 6% range as forecast, and if builders ramp up new construction to meet pent-up demand, Bonita Springs and Estero could see a vibrant market in 2026 marked by steady sales, gradually rising prices, and ample choices for buyers.

In summary, Southwest Florida’s real estate market entering late 2025 is on a stronger footing than a year ago – a boon for the “2025 Florida housing outlook” and beyond. Buyers have more options and a bit more negotiating power, while sellers are adjusting to slightly longer timelines but still benefiting from solid prices and population-driven demand. With the recent Fed rate cuts easing a key constraint, consumer confidence is improving at a critical time. Local Realtors® are advising clients that early-season 2026 may be an ideal window: increased inventory and lower rates are intersecting with the annual surge of snowbird buyers, potentially creating a busy and fruitful market for all. The data from October 2025 delivers a clear message – this market is rebounding, not retreating. As long as economic conditions stay favorable, Bonita Springs and Estero housing trends should continue on this positive trajectory, making 2025–2026 a promising period for Southwest Florida real estate.